Wells Fargo checking accountsWells Fargo has five different options for personal checking accounts — Everyday, Preferred, Portfolio, Teen and Opportunity. Businesses can select from Simple, Choice Platinum and Analyzed checking accounts. Most personal and business checking accounts require a $25 deposit to open.Wells Fargo savings accounts and CDsWells Fargo offers two savings account options, Way2Save and Platinum Savings. Wells Fargo also offers CDs, which require at least a $2,500 minimum opening deposit. CDs are available at fixed rates and step rates.Wells Fargo loansWells Fargo offers multiple loan types, including student loans, auto loans and mortgage loans to help you buy, refinance or renovate a home. The bank offers low-APR personal loans and lines of credit ranging from $3,000 to $100,000.

Wells Fargo also provides loans and lines of credit for businesses.Wells Fargo credit cardsWells Fargo has several credit card options. Almost all Wells Fargo cards have a cash back or reward program, and a few have no annual fee.Wells Fargo retirement servicesWells Fargo offers traditional and Roth IRAs. You can also invest in mutual funds and manage your portfolio yourself or with the help of a Wells Fargo investment professional. The WellsTrade Mutual Fund Screened Listed makes investing simple by pre-screening mutual funds.

Wells Fargo Advisors, a full-service brokerage, is available to customers to help with investment planning. Mobile payments are available for Apple Pay, Google Pay and Samsung Pay. Wells Fargo benefits for business owners also include Clover point-of-sale systems customized fit your business needs. Wells Fargo's monthly service fees for checking accounts range from $0 to $30, though service fees are waived for teenagers and college students between 17 to 24 years old. Monthly service fees for business checking accounts range from $10 to $40. The bank charges a $5 or $12 monthly fee on savings accounts.

Wells Fargo's checking account fees can be avoided by maintaining a specific average balance or completing a minimum number of transactions each month. Also, expect fees for late credit card payments and overdraft charges unless your checking and savings accounts are linked. Capital One's business banking options are generally more comprehensive than some of its competitors. For starters, the bank offers what it calls Spark Business Banking, which is the platform through which its business bank accounts are run through. With Spark Business Banking, you'll also have access to personalized guidance and advice. With Capital One, you can take advantage of a range of business products, such as checking accounts, savings accounts, loans, lines of credits and other lending options.

The bank even boasts a variety of credit cards and merchant services to keep your business going. Wells Fargo offers many options to handle your financial needs, including checking and savings accounts, credit cards, investments and loans. Compared to other banks, interest rates and fees are average. Overall, Wells Fargo's products and services are robust and allow you the convenience to bank however and wherever you like. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions between enrolled users typically occur in minutes.

For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement.

When it comes to business checking accounts, customers can choose between either the Spark Business Basic Checking account or the Spark Business Unlimited Checking account. Each account comes with unlimited transactions, a waivable monthly service fee and online and mobile banking features. However, the Spark Business Unlimited Checking account is designed for larger businesses, while the Spark Business Basic Checking account might be better for small businesses. Specialized checking accounts are also available for specific needs, such as escrow. SmartAsset researched the small business offerings of nearly 30 national, regional and online banks. Key Bank's Hassle-Free checking account is ideal for consumers looking for a free, no-frills checking account.

This account's digital features are designed to accommodate the modern consumer, and it comes with a debit card, online bill pay and mobile banking rather than paper checks. The account also has no monthly service fee and no overdraft fees. In our search for the best checking accounts for Colorado residents, we focused on banks that have low monthly fees, efficient online banking apps and convenient branch locations throughout the state.

If you want to focus your banking business at one institution, these banks also provide decent savings and money market account options. PNC Bank only operates branches in about half of the U.S., with most being located in the eastern and central parts of the country. However, the bank has great business offerings and has significant online and mobile features, making it a viable option even for those who don't live near a branch. Businesses that choose to bank with PNC will have access to both checking and savings accounts, credit cards, merchant services and various types of loans.

This account allows customers to earn interest on their checking balances over $500. The account owners can order cashier's checks from the bank without any additional fees. Since the typical fee is up to $10, those using cashier's checks often can save significantly.

If you prefer personal checks, you'll also get a $10 discount. Typically, customers with personal lines of credit can borrow between $3,000 and $100,000, with variable interest rates ranging from 9.5 to 21 percent. The product was marketed as a way for customers to pay for something big like a home renovation, or to consolidate high-interest credit card debt.

The bank said it is discontinuing the product so it can focus on personal loans and credit cards, and warned in its letter that the closure of the accounts "may have an impact on your credit score." If you work with PNC, you'll be able to take advantage of a range of small business loan and financing options. Some loans require no collateral, while others are meant for specific purposes, like real estate or equipment. You'll also have the opportunity to open business credit cards, use the bank for merchant services and earn APYs on a variety of business savings products. All checking account holders receive a debit card to use as they please.

But much like a credit card, these can actually earn you rewards through Keybank's Relationship Rewards® program. You will earn rewards points every time you swipe your debit card, use online bill pay, make ATM and mobile deposits or complete a number of other account-related activities. These points can later be redeemed for cash back, travel credit, gift cards and more. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank.

Other banks have attempted to emulate Wells Fargo's cross-selling practices . If you want to pay your bills or make purchases electronically, one option may be to open a checking account. This will allow you to withdraw or deposit funds easily, and if you use a debit card, you can make purchases with the card. It is helpful to understand the fees associated with any account before you sign up, as some institutions require a minimum monthly balance or they may offer fee waivers for some services depending on the type of account you have. Mobile banking, account alerts, and apps can be helpful tools to help you monitor your balance on the go, which may help prevent you from overdrawing the account.

There's also Clear Access Banking, another checking account targeting students and young people. It offers the same option to waive the monthly fee if you meet certain criteria. Plus, it's designed specifically with digital-loving users in mind, with a great mobile banking app, contactless debit card and other digital banking features. Customers can use a debit card with contactless and chip technology instead, pay bills online, and make digital payments. Mobile deposit is only available through the Wells Fargo Mobile app.

$5 monthly service fee is waived for primary account owners 13 to 24 years old, although teens 13 to 16 need an adult co-owner. To open a checking account online, you'll have to indicate a zip code for the US city of your residence. You also have the opportunity to open both an individual and joint bank account, so you have to choose a suitable variant. With a joint account, you and your partner can pay shared household expenses, such as a mortgage, car payments, utilities, and groceries, from the same place. Moreover, joint account funding may help you meet the minimum balance requirements that qualify you for features like waived maintenance fees, a higher interest rate, or additional rewards. For consumers who desire affordability, the Wells Fargo Everyday Checking Account is a solid checking option with minimal fees.

The account can be opened online or at any Wells Fargo branch with a $25.00 deposit, and it comes with a full suite of online banking capabilities—including bill pay, transfers and budgeting tools. The $10.00 monthly fee can be waived if you make 10 debit card purchases, deposit at least $500.00 or maintain a daily $1,500 balance every month. The choice of where to do your business banking is often more complex than a single checking account. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account.

Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area.

The most popular Wells Fargo checking account has custom text and email alerts to monitor account activities. It's supplemented by a Platinum debit card with chip technology. Unlike Clear Access Banking, this account has a check-writing option. It also brings additional benefits to students if Wells Fargo Campus ATM or Campus Debit Card is linked. The fee is waived if the owner has a $500 minimum daily balance or $500 and more in total qualifying direct deposits.

You can also enjoy a zero service fee if you are 17 through 24 years old or have a linked Wells Fargo Campus Card. A revolving credit option for everyday business expenses for a company with up to $2 million in annual sales that needs fewer than 100 cards. Looking for a bank that offers a variety of business account options and services? With checking and savings accounts, as well as business financing and merchant services, Wells Fargo is a great all-around banking option for businesses. It comes with a cheap cost, including no monthly fees, 25 free cash deposits and 125 free transactions a month. You will also receive a debit card, remote check deposit and online/mobile banking, giving account holders just about everything they'll likely need.

Outside of its banking products, Regions provides its business clients with a plethora of other services. These include business credit cards, secured and unsecured loans, lines of credit, equipment loans, cash management tools, merchant services, payroll and benefit services and more. This makes Regions one of the most robust small business banks on this list. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period.

Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. A business bank accountis a checking account set up specifically for business incomes and outflows, allowing individuals to keep their professional financial affairs and transactions separate from their personal ones. Business accounts often provide features that are uncommon for individual accounts. These features include initiating wires or ACH payments, delegating account authority/privileges to other parties , and cash management tools like positive pay. College credit cards may be offered to college students with limited credit histories, and some come with introductory interest rates, or rewards options. In some cases, students who do not meet these criteria on their own may have to apply with a co-applicant who has the ability to repay the debt in order to qualify.

A credit card in your own name may help you build a credit history that can serve you well when you need to get other credit products like a car loan. Missed or late payments can have a negative impact on your credit, so be sure to spend wisely and stay on top of your bills to avoid accumulating debt on your card. You'll find that you probably won't have access to the same banking market as US citizens. You should still be able to get a personal or business bank account as a non-citizen, but you'll be limited to banks which offer specific bank accounts for customers in your circumstances.

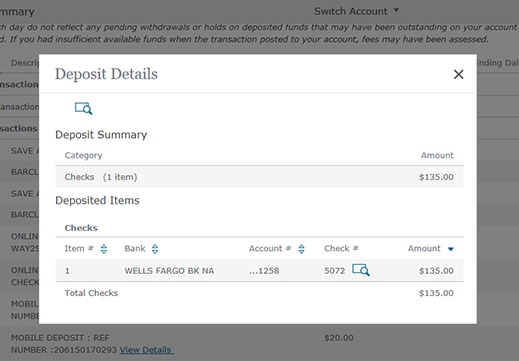

Wells Fargo provides banking, investment and mortgage services as well as commercial and consumer financing at 7,600 locations in 32 countries and territories around the globe. Wells Fargo mobile banking gives customers the ability to link their checking, savings, credit card and investment accounts all in one place. Customers can also deposit checks from their phones with the Wells Fargo app.

Gives customers unlimited branch and ATM withdrawals and the option to write checks. Optional overdraft protection for your checking account is another benefit. The account is better suited to those having higher savings goals. Thus, the monthly service fee of $12 is waived when you maintain a $3,500 minimum daily balance each fee period. Provides a variety of automatic savings options if it's linked to a Wells Fargo checking account.

Teens and students under 24 are exempt from the $5 monthly fee. Even if you're older, you can use the account for free by fulfilling minimum automatic deposit requirements. Еhe premium service for eligible customers offers bonus interest rates as well as zero-commission at external ATMs .

The account owners get interest on their account balance, earn rewards, receive loan discounts, and are served by the Premier support team. No fees incurred for Wells Fargo Personal Wallet checks, cashier's checks, and money orders. The monthly $30 fee is waived for those having $25,000 or more in qualifying linked bank deposits, or over $50,000 in qualifying linked bank, brokerage, and credit balances. Premium clients also get an annual Relationship bonus on the non-bonus rewards points they earn with the Wells Fargo Propel World American Express Card.

Wells Fargo offers to check and savings account options to both resident and non-resident foreigners. The accounts can usually be linked to a debit card or an ATM card – giving you quick access to cash – and can be managed online, as well as at ATMs. However, those who reside within the US have the advantage of opening their accounts online, which is a great benefit while pandemic health concerns still occur. Non-residents would have to visit one of the bank's numerous branches in person. The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform.

When looking for a small business bank account, consider how many deposit and debit transactions you make per month. Most banks charge higher monthly fees in exchange for allowing more transactions, and will penalize you anywhere from $0.25 to $0.75 per transaction for exceeding the limit. Both of our recommended accounts below allow 500 transactions per month and charge reasonable transaction penalty fees. The bank also has a robust offering of business credit cards, such as the Ink Business Preferred Credit Card. This card currently holds a place on SmartAsset's list of the best small business credit cards. With Chase, you'll also have access to fraud protections and merchant services to help you run your business smoothly.

In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.